Introduction

When the U.S. announced new tariff hikes on Indian imports, most coverage focused on fears of export losses, trade tension, and manufacturing slowdowns. However, the core story for Indian D2C and e-commerce brands is about how these businesses are making strategic adjustments and uncovering unexpected opportunities.

While there is pressure and costs are rising, some Indian products now face steep tariff increases of up to 50%, the situation is not one-dimensional. Here is an additional perspective that is often missed:

Every tariff has a ripple effect, and some ripples create waves of opportunity.

In other words, Indian D2C brands are not retreating; they are adapting more quickly, intelligently, and profitably than expected.

For example, agricultural exporters are shifting to value-added products, and apparel sellers are pivoting to specialty categories with better margins. Indian exporters are beginning to treat tariffs as a filter rather than a barrier.

If you are a growing e-commerce or D2C brand, this period is less about reacting and more about repositioning for the future.

Below, we break down the effects of these U.S. tariffs on India and, more importantly, examine how Indian sellers are strategically leveraging the situation.

1. What’s happening now that the US is imposing steep tariffs on India

In early 2025, the U.S. announced a phase of reciprocal duties and penalties, declaring that Indian exports would face additional tariffs in some cases up to 50%.

For example, the consultancy KPMG notes that “the U.S. imposed a 25 % tariff along with an additional 25 % levy on India … bringing tariffs as high as 50%”. A recent Reuters report confirms that Indian exports to the U.S. fell 8.6% year-on-year to $6.3 billion in October 2025, following the 50% tariffs that came into effect early this year 2025.

2. Why this move matters in the trade context & India’s export profile

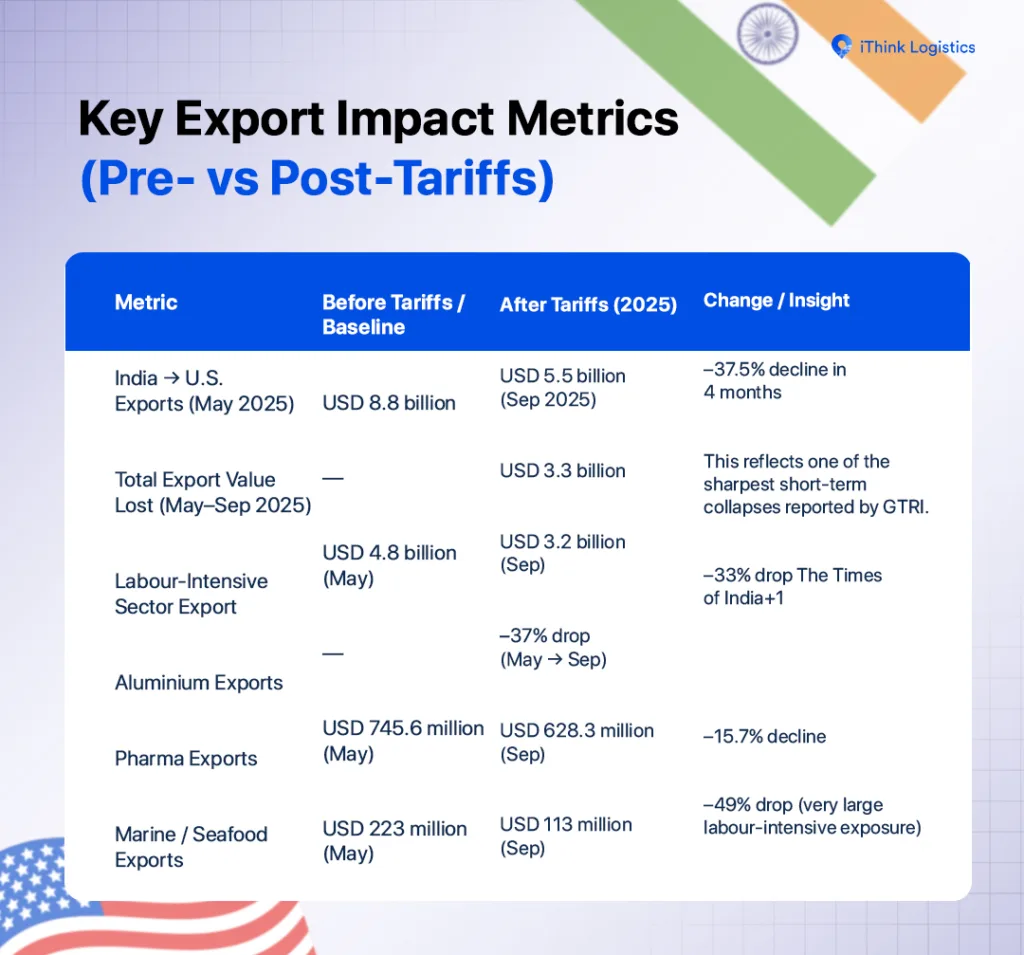

It’s not just a headline. The U.S. is one of India’s largest export destinations: while exact figures vary, data shows that exports to the U.S. account for a significant share of India’s labour-intensive manufacturing and D2C-friendly goods. For instance, an Economic Times report found that India’s exports to the U.S. fell 37.5% between May and September 2025 from USD 8.8 billion to USD 5.5 billion.

Why did the U.S. act? Multiple reasons:

- The U.S. cited trade imbalance and higher Indian import duties as justifications.

- It also linked tariffs to India’s continued purchase of Russian oil, making tariffs part of a broader geopolitical calculus.

- With the U.S. and India negotiating a possible trade deal(“US-India trade deal”), this tariff move increases leverage in the talks.

3. Which export sectors & D2C goods are most exposed

From our iThinkLogistics data and external reports, here’s how exposure looks:

- Textiles, apparel, and readymade garments: major drop in U.S. orders, while buyers are calling to absorb an additional 20-30% in IT costs.

- Gems & jewellery: one of the worst-hit.

- Marine products / seafood: significant exposure to U.S. demand.

- Engineering goods, metals, chemicals: while exposed, somewhat insulated because several face global tariffs. For example, aluminum exports fell 37% in a single period.

For D2C brands in India that export: if your product falls into any of these categories (fashion/accessories, home-lifestyle, jewellery, luxury goods, niche engineering / specialty goods), you must recognize that “U.S. tariffs on India imports” means your export to the U.S. is now costlier and more risky.

Also Read: Complete Guide to International Shipping from India

4. The silver lining & strategic pivot opportunities

Now here’s where we at iThinkLogistics believe there is real opportunity (not just risk).

a) Market diversification pays off

Recent research shows India is widening its export base. As U.S. shipments slowed after tariff hikes, exports to other countries have increased significantly. According to an SBI export-basket report, India’s merchandise exports overall rose in 2025, while the share destined for the U.S. fell — signalling a shift.

India’s export share to the U.S. has fallen, while the UAE, Vietnam, Bangladesh, etc., are gaining ground.

b) Premiumization & moving up the value chain

Tariffs hit commoditized, low-margin goods hardest, making it difficult to be profitable and hold the US market. D2C brands need to shift to premiumised, branded offerings where consumers are willing to pay higher prices or add services (e.g., customization, subscriptions).

Premium buyers don’t mind spending extra to get the value of the product and services regardless of the tariff. This is important to implement as commodity products, something US customers can get for cheaper.

c) Domestic & export logistics optimization

With tariff and demand uncertainties, exporters are rethinking how they move goods globally. Many are optimizing by redirecting export flows to markets beyond the U.S., reducing dependence on a single region, and effectively hedging risk.

For example, sectors such as marine products (seafood, shrimp) have seen a surge in demand from non-U.S. buyers, helping spread risk and reducing the impact of U.S.-specific trade shocks.

5. What Indian D2C & e-Commerce Sellers Should Do Now? Step by step

Here’s your operational checklist as an Indian seller:

Step 1: Export-SKU Audit & Compliance Readiness

Begin by identifying risks and establishing a robust compliance framework, as the penalties for non-compliance are now more significant than before.

- Map Tariff Risk & Margin Impact: Immediately identify every SKU you export (or plan to export) to the U.S. and map them to the High-Tariff Risk category (e.g., fashion, home-lifestyle, jewellery). For these products, determine the exact new Landed Cost Per Unit (LCPU) to reveal which are no longer competitive under the full duty load.

- Mandatory Compliance Upgrade: The simplified shipping methods are obsolete. Ensure all product documents include accurate HSN (Harmonized System) Codes and precise valuation. You cannot afford customs delays or penalties now.

Step 2: Re-map Distribution Geographies & Trade Diplomacy

Right now, diversification is the best option. Reducing over-reliance by leveraging existing preferential agreements and growing demand in other countries.

- Diversify Export Basket: While maintaining a strategic focus on the U.S., aggressively expand into high-potential alternative geos with better trade terms: the Middle East, Australia, the UK/EU, and Southeast Asia. This pivot is the direct answer to the impact of U.S. tariffs on India.

- Set Measurable Targets: Set an ambitious, clear goal to export volume of trade outside the U.S. within the next 12 months. This diversification is your insurance policy against the next trade shock.

- Leverage Government Support: Actively track and apply for benefits under new national export promotion schemes to secure the finance you need to scale new markets and mitigate the cost pressure from the US imposing tariffs on India.

Step 3: Review Pricing, Value Proposition, and Premiumization

Tariffs impact low-margin sellers the most. If possible, promote a premium brand that customers are willing to pay more for. Focus on transitioning from low-value to high-value products.

- Scenario-Based Pricing: Model multiple pricing scenarios based on whether you absorb the tariff cost (margin reduction) or pass it to the customer (which risks losing customers to a lower price for the same product from different countries). This will inform your ultimate pricing strategy to counter the US tariff impact on India.

- Pivot to Value-Add: Shift your production from commoditized goods to high-margin, branded, specialized SKUs (e.g., customization, ethical sourcing, specialty craft).

Step 4: Optimize Logistics & Duty Planning (Bulk Strategy)

The previous strategy of relying on individual, low-cost shipments is now outdated. Your approach should now prioritize efficient, consolidated, and duty-prepaid systems.

Use Duty-Paid Shipping (DDP): Hidden customs charges scare U.S. buyers at delivery and lower conversions. With Delivered Duty Paid (DDP), duties are paid upfront before the order reaches the customer. This keeps prices clear, prevents delivery surprises, and makes buyers more confident.

Step 5: Track Performance & Build Resilience

Now, the metrics you track will determine your ability to withstand tariff pressure. Move beyond traditional metrics and measure those that protect your margins.

Watch the Metrics That Matter

Create simple dashboards that monitor:

- Growth in non-U.S. markets (your real diversification score)

- Landed Cost per Unit (LCPU) for U.S. shipments

- Margin per Unit for high-tariff categories like apparel, lifestyle, and jewellery

These are the numbers that tell you whether you’re growing smart or not growing.

Prepare for Trade Shifts

Trade talks around the U.S.-India deal may reduce duties later, but your strategy shouldn’t wait for policy changes.

Stay ready to scale U.S. volumes if tariffs are removed, but build operations assuming they won’t be.

That’s how resilient brands plan: flexible if things improve, stable if they don’t.

6. Where trade negotiations stand & what it signals

Regarding “US-India trade agreements” and “US-India trade deal”: the negotiation climate is evolving. Recent reports show that India’s resilient domestic economy has given it space to negotiate.

Industry analysts believe that any successful deal could reduce tariffs, ease export pressure and restore competitiveness.

For e-commerce sellers, this means staying agile: if a deal emerges, you may get tariff relief, but you must act now because timing matters.

7. Final thoughts: Seize the moment

Yes, the impact of US tariffs on India is real and substantial. It’s shifting exports, raising costs, and disrupting familiar trade flows. But for Indian D2C & e-commerce brands, this moment also opens a strategic window:

- Those who view it as a wake-up call (not just a threat) will diversify, upgrade, and optimize.

- By acting now, auditing exports, shifting geographies, refining logistics, and telling stronger brand stories, you’ll not just safeguard your business; you may come out stronger than competitors stuck in old paradigms.

If your brand is exporting, or planning to, then this is your strategic moment. Analyze your risk, act fast, upgrade your export systems and don’t wait for a deal to save you. You’ll save yourself.